The car market in Qatar clearly reflects the path of the economic and social transformations the country is experiencing. With the doubling of vehicles and the growing reliance on them in daily life, new challenges and opportunities have emerged simultaneously, making this sector a central pillar in shaping the features of future development and competitiveness.

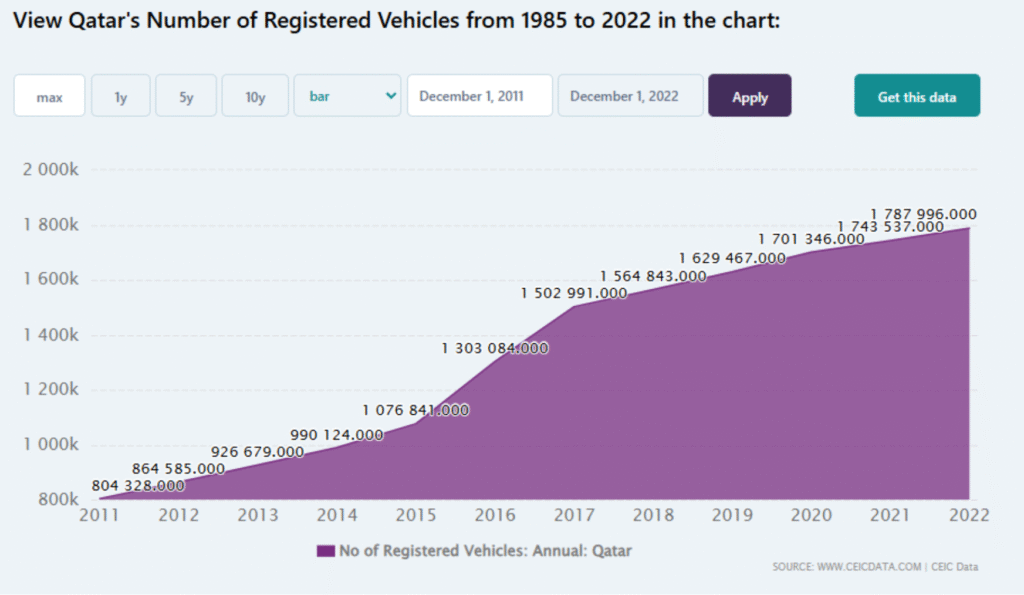

According to data published by the CEIC Data website, the number of registered vehicles in Qatar reached about 1.788 million in December 2022, the highest figure recorded since documentation began nearly four decades ago. This marks a notable increase compared to 2021, when the number of vehicles stood at about 1.744 million, indicating steady expansion in vehicle registration and growing dependence on them in both daily life and the national economy.

After the number of registered vehicles was around 125,000 in 1985, the figures began to climb rapidly, with the annual average between 1985 and 2022 amounting to just under 385,000 cars.

This major transformation cannot be understood in isolation from the economic and social growth Qatar has witnessed. The increase in national wealth, the expansion of infrastructure, and the rise in population have all contributed to making vehicles an indispensable necessity, whether for personal use or for the business and services sector.

The continuous rise in the number of registered vehicles is not merely a reflection of higher income or population growth, but rather an indicator of lifestyle changes and urban expansion. With the growth of cities and the emergence of new residential and commercial clusters, reliance on private vehicles has become almost inevitable.

Furthermore, the growing economic activity, particularly in trade and logistics services, has fueled demand for various types of commercial vehicles, driving record numbers year after year.

Reaching nearly 1.8 million registered vehicles reveals both opportunities and challenges. On one hand, this growth stimulates multiple economic sectors such as the automotive sales market, maintenance services, insurance companies, and banks that provide vehicle financing.

On the other hand, it reflects increasing economic vitality and the expansion of private investments, while simultaneously posing major challenges for traffic management and road safety. Vehicle density leads to congestion, strains infrastructure, and contributes to environmental impact through rising emissions.

Qatar has responded to these challenges by developing a modern road network, building tunnels and bridges, and introducing mass transit systems such as the metro and smart buses.

These projects reflect the state’s vision of striking a balance between the rapid growth in vehicle numbers and the need to ensure smooth traffic flow and sustainable transport. Nevertheless, the challenge remains in how to encourage society to adopt public transportation alternatives and reduce excessive dependence on private cars.

Looking at current trends, Qatar has developed integrated transport systems capable of handling pressure. The road to the future is not measured only by the number of registered cars, but by the ability to turn this growth into an opportunity to enhance transport efficiency, ease traffic burdens, and strike a balance between economic expansion and environmental preservation.

An article on the Msheireb website titled The Best-Selling Cars in Qatar in 2024 provides an overview of the automotive market by tracking the most popular models. Leading the scene was the Chinese Jetour T2, with sales of 3,976 cars. While this figure may seem modest compared to larger markets, it reflects profound shifts in Qatari consumer preferences.

Behind it came the Toyota Hilux with 2,653 units sold, followed by the Nissan Patrol with 2,545, then the Lexus LX with 2,437, and the Nissan Sunny with 1,991. These figures highlight the continued dominance of Japanese luxury and traditional brands, alongside the remarkable rise of Chinese cars.

What stands out is that the report did not limit itself to listing numbers, but linked them to the reality of the Chinese auto industry, which is rapidly moving toward global prominence. It relies on digital development, artificial intelligence, and integrated production lines, enabling it to offer competitive products at reasonable prices without compromising consumer appeal.

One of the key insights of the article is that, despite the relatively small size of the Qatari market—where even the top-selling model did not exceed 4,000 units in a year—the arrival of new brands such as Jetour with strong momentum confirms that Qatar’s market serves as a testing ground and an indicator of transformations that could extend to the wider Gulf and regional markets.

On one hand, Qatari consumers maintain their trust in Japanese brands long associated with reliability and luxury. On the other, there is growing openness to Chinese alternatives that combine competitive pricing with modern technology. This balance could reshape Qatar’s automotive market in the coming years, where the scene is no longer dominated by traditional players alone but now includes new competitors with ambitions far greater than the figures of 2024 reveal.

At the beginning of 2025, Qatar took a bold and unprecedented step in the region’s markets when the Ministry of Commerce and Industry issued Circular No. (1), which, for the first time, allowed individuals to directly import cars for personal use. The decision was not just a legal update, but rather a historic turning point that reshaped the relationship between the consumer and the dealer, laying new foundations for trade freedom and competitiveness in a sector long characterized by monopoly and restrictions.

This legislative shift came in response to repeated consumer demands to break the monopoly and open the door to broader choices. It reflects a new economic philosophy based on empowering individuals and enhancing competition, in line with the state’s direction to build an open, diversified economy rooted in efficiency and transparency.

For many years, Qatar’s car market was tied to official dealers who monopolized the processes of import, distribution, and maintenance. Consumers were captive to the prices imposed by the dealer, limited model options, and after-sales services that were not always up to standard. Yet, they had little choice but to accept these conditions due to the absence of a legal alternative for individual imports.

But with the new decision, the path has been opened for citizens and residents to import cars from anywhere in the world, provided they comply with GCC specifications. This has turned the equation upside down: dealers are no longer the sole controllers of the market but have become just one of several options, meaning they must improve their services and adjust prices to remain competitive.

What most caught public attention about the decision was the requirement for local dealers to provide warranties, maintenance, and spare parts for directly imported vehicles. Even if a consumer purchases a car from outside the local market, they remain protected under Consumer Protection Law No. (8) of 2008.

This obligation prevents dealers from using the excuse that a car was not bought locally to evade their services—something many consumers had feared. Now, if a manufacturing defect arises, the consumer has the right to receive maintenance or replacement under the same conditions applied to cars sold locally. This marks a qualitative leap in safeguarding consumer rights and reflects the state’s commitment to expanding the scope of legal protection.

There is no doubt that opening the market to direct imports has significant economic effects. It will create strong competition between dealers and individual importers, leading to lower prices and greater variety of choices.

While dealers may lose part of their profits due to the end of monopoly practices, the market as a whole will benefit from higher quality and reduced prices. Consumers who once had to buy cars at higher local prices can now save considerable amounts through direct import.

On another level, the decision may positively impact the broader economy by stimulating the logistics, shipping, insurance, and customs clearance sectors, all of which are expected to experience accelerated growth as individual imports increase.

With this major opening in import options, it became necessary to establish regulations that protect both consumers and the market. For this reason, compliance with GCC specifications has remained a primary condition for a car to be accepted.

These specifications are not merely formal rules; they are the result of decades of experience in the harsh Gulf environment. They include powerful cooling systems that can withstand summer temperatures exceeding 50°C, rust-resistant materials to counter humidity and salinity, and safety systems adapted to road conditions and dust.

Naturally, ignoring these specifications could make a car prone to frequent breakdowns, nullifying the benefit of lower purchase prices. Therefore, automotive experts advised consumers to verify a vehicle’s compliance by checking its chassis number with the local dealer before making a purchase decision.

Minister of Economy and Trade Decision No. (21) of 2004 on the regulation of importing used vehicles clarified the rules, frameworks, and categories allowed for import. Citizens and residents over the age of 18 can import light vehicles no older than five years, or heavy vehicles no older than ten years.

As for classic cars older than 35 years, they were given special status, as their import was permitted without restrictions, in recognition of their heritage value and the growing hobby of collecting rare cars.

On the other hand, the import of vehicles damaged by accidents, fires, or flooding was prohibited, as well as taxis, police cars, and vehicles that had their steering converted from right-hand drive to left-hand drive, in order to avoid technical and safety risks.

As shown on the website of the General Authority of Customs, commercial import differs from personal import. Commercial import requires proof of the importer’s business activity to obtain a customs code, as well as the necessary permits for restricted goods. Customs may also require the translation of invoices or foreign documents.

The importer or their representative is obliged to keep records for five years and present documents either electronically or in paper form upon request. Documents must be original, though invoice copies may be temporarily accepted with a commitment to provide the originals within 90 days or by submitting a financial guarantee.

Customs duties must be paid in advance through the electronic clearance system. Goods are subject to inspection and examination according to risk standards before the release permit is issued. The import of prohibited, counterfeit, or non-compliant goods is banned, though certificates of conformity or laboratory reports from the country of origin may be requested.

Personal import, on the other hand, is limited to individuals not engaged in trade. Shipments must be of a personal nature and in non-commercial quantities. The importer must present a personal ID card, passport, or residence permit and obtain the required permits for restricted goods.

Documents may be submitted electronically, but original invoices must still be provided upon request. The importer is required to pay customs duties in advance, and goods are subject to inspection and examination under risk standards before being cleared. The import of internationally or locally prohibited goods, counterfeit or fraudulent items, or those that violate approved specifications and intellectual property rights is strictly prohibited.

The evolution of Qatar’s automotive market—from the doubling of registered vehicles to the entry of new brands, culminating in the historic decision to open direct import for individuals—reflects a broader picture of a country striving to balance market freedom with consumer protection. The landscape is no longer confined to sales figures or customs regulations but has become part of Qatar’s broader story of economic, social, and legislative transformation.

As competition accelerates and options diversify, the most important challenge remains the ability to channel this dynamism toward building a fairer, more efficient, and sustainable market—one that protects individual interests while strengthening Qatar’s position as a leading regional hub for trade, transport, and the modern economy.