During each visit to a grocery store, juice shop, or mobile accessories store, I’ve often noticed the near-total dominance of Indian businesses in these sectors in the Gulf countries. This success extends to many supermarkets and even some major retail stores.

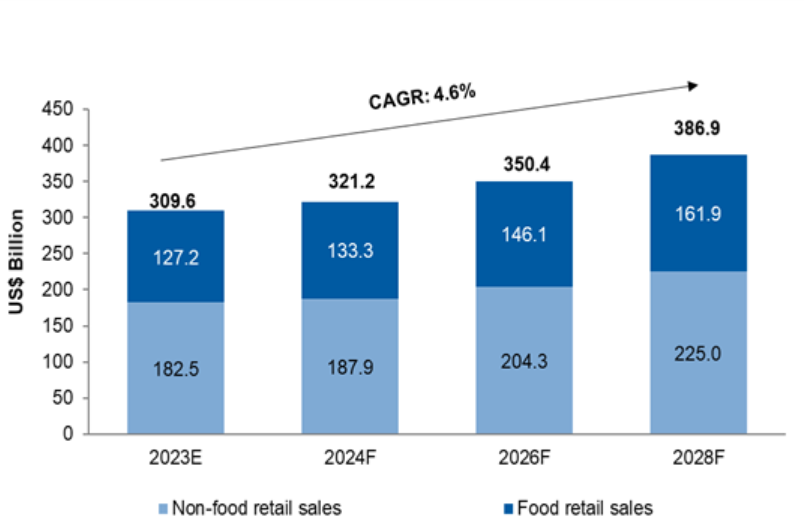

According to Statista, the grocery delivery market in the Gulf Cooperation Council (GCC) countries is expected to reach approximately $5 billion by 2029.

Undoubtedly, any private business, even if small, has its appeal, as it promises the owner freedom from employment and working for others. However, it’s also important to recognize that private ventures do not necessarily bring financial independence but may carry risks of wasted money, effort, or even falling into debt.

For this reason, partnerships have become one of the most important mechanisms for those aspiring to start a private business. Article (2) of Law No. 11 of 2015, on Promulgating the Commercial Companies Law, defines the concept of a commercial company as “a contract under which two or more natural or legal persons agree to contribute to a profit-seeking project by providing a share of money or labor, and share any profit or loss arising from the project. A company may also be established by a single person in accordance with the provisions of Part Eight of this law.”

In general, Article (8) states that “except for joint ventures, a company does not have legal personality until it is registered in accordance with the provisions of this law, and the company’s managers or board members, as the case may be, are jointly liable for damages caused to others due to the failure to register the company.”

Companies in Qatari law are classified into eight types: General Partnership, Simple Limited Partnership, Joint Venture, Public Joint Stock Company, Private Joint Stock Company, Partnership Limited by Shares, Limited Liability Company, and Holding Company.

General Partnership

Chapter Two of the law above defines a general partnership and allocates Articles (21) to (44). Article (21) describes it as “a company formed by two or more natural persons who are jointly liable with all their assets for the company’s obligations.” It is called a general partnership because the partners must guarantee the company with their assets. According to Article (29), the company’s creditors have “the right to claim against the company’s assets, and they also have the right to claim against any partner’s assets.”

This right of creditors to claim personal assets applies to current partners and extends to any new partner who joins the company. According to Article (31), the new partner “is jointly liable with the other partners for all the company’s debts incurred before and after joining, and any agreement between the partners to the contrary cannot be invoked against third parties.”

As for company decisions, according to Article (34), they are issued “only by unanimous agreement of the partners unless the company contract provides otherwise.”

Regarding administrative aspects, Article (43) stipulates that “a non-managing partner is not permitted to interfere in the company’s management. However, they can personally access the company’s operations at its headquarters, review its books and documents, obtain a summary of the company’s financial status, either personally or through an agent, and provide advice to the manager. Any agreement to the contrary is considered void.”

According to Article (37), no managing partner in the company can be dismissed “except by unanimous consent of the other partners or by a decision from the competent court upon the request of the majority of partners. The dismissal of the manager in either case results in the dissolution of the company unless the company contract provides otherwise. If the manager is a partner and appointed in a separate contract from the company contract or is a non-partner, whether appointed in the company contract or a separate contract, they may be dismissed by a decision of the majority of partners, and such dismissal does not result in the dissolution of the company.”

However, the manager’s authority is not absolute. According to Article (40), “the manager is not permitted to undertake transactions beyond ordinary management without the partners’ approval or an explicit provision in the contract. This restriction particularly applies to the following actions: donations, except for small customary donations, the sale of the company’s real estate unless such transactions are part of the company’s objectives, mortgaging the company’s real estate even if authorized to sell it in the contract, the sale or mortgaging of the company’s store, or guaranteeing the debts of third parties.”

Simple Limited Partnership

The third chapter of this law defines the Simple Limited Partnership and allocates articles (45) to (52) to it. According to article (52), it is subject to the same rules as the General Partnership, except for the provisions outlined in this chapter. Article (45) defines it as “a company consisting of two categories of partners: general partners, who manage the company and are jointly liable for all its obligations with their assets, and limited partners, who contribute to the company’s capital without being liable for its obligations beyond the amount they contributed or pledged to contribute.”

However, article (46) specifies that “all general partners must be natural persons.”

As for the limited partner, article (48) states that their name cannot appear in the company’s name. “If it does, with their knowledge, they become jointly liable for its obligations to third parties in good faith.”

Furthermore, article (49) states that the limited partner “cannot intervene in the company’s management, even by proxy. Otherwise, they will become jointly liable for the obligations arising from their management actions. They may, however, be held liable for all or some of the company’s obligations, depending on the seriousness and frequency of their actions and the trust placed in them by others due to those actions. Monitoring the managers’ conduct, offering advice, and permitting them to act outside their authority are not considered acts of intervention.”

Joint Venture Company (Shirkah Muhasa)

Chapter four of this law defines the Joint Venture Company, detailing its provisions in Articles (53) to (61). Article (53) defines it as a “concealed company that does not have legal standing before third parties, nor does it enjoy legal personality, and is not subject to any formal registration procedures.”

According to Article (60), the company’s decisions can only be made with “unanimous agreement of the partners, unless otherwise stated in the company contract. Any decisions to amend the company contract are invalid unless made with all partners’ unanimous consent.”

Additionally, as per Article (61), a “non-Qatari partner is prohibited from engaging in activities restricted by law to Qatari nationals.”

Public Joint Stock Company

The fifth chapter of this law defines the Public Joint Stock Company and dedicates articles (62) to (204) to it. Article (62) defines it as “a company whose capital is divided into equal-value, tradable shares, and the shareholders are only liable up to the extent of their contributions to the capital.”

According to Article (64), the company must have “a specified duration mentioned in the company’s contract and articles of association, and the company’s term may be extended by a resolution from the extraordinary general assembly. Suppose the company’s purpose is to carry out a specific task. In that case, it dissolves upon completion of that task.” Article (65) stipulates that “the company’s capital must not be less than ten million riyals.”

As per Article (67), “no fewer than five founders found a Public Joint Stock Company, and the company must offer its shares for public subscription within sixty days of its establishment. Suppose the company fails to do so within that period. In that case, it automatically dissolves unless the founders, within thirty days of the end of the subscription period, amend the company’s contract and articles of association to convert it into another form of company provided for in this law. The founders bear the costs of this conversion, including any fees and financial penalties imposed by the ministry. They are liable for all their assets and the company’s obligations during this period.”

The term “ministry”, as used in Article (1), is defined as “the Ministry of Economy and Commerce unless the context indicates otherwise.”

Article (128), amended by Law No. (8) of 2021 stipulates that “every shareholder has the right to attend general assembly meetings and has several votes equal to their shares. Decisions are passed by an absolute majority of shares represented in the meeting. Minors and legally incapacitated individuals are represented by their legal guardians. Shareholders may appoint a proxy to attend general assembly meetings, provided the proxy is also a shareholder and is specifically authorized in writing. A shareholder may not appoint a board of directors member as their proxy. In any case, the number of shares the proxy holds in this capacity must not exceed (5%) of the capital.”

Regarding bonds, Article (171) states that Public Joint Stock Companies may only issue bonds under the following conditions: “It must be authorized in the company’s articles of association, the company’s capital must be fully paid, and the value of the bonds must not exceed the existing capital according to the latest approved balance sheet unless the bonds are guaranteed by the state or a local bank.”

The capital of a Public Joint Stock Company can only be increased, according to Article (192), by “issuing new shares, capitalizing reserves or part of them, capitalizing profits, converting bonds into shares, or issuing new shares in exchange for in-kind contributions or appraised rights.”

Private Joint Stock Company

Chapter six of this law defines the Private Joint Stock Company, detailed in Articles 205 to 208. Article 205 states that “a minimum of five founders may establish a private joint stock company among themselves, without offering its shares for public subscription, with all founders subscribing to the shares. The company’s capital must not be less than two million riyals.”

It is noted in Article 206 that “except for the provisions regarding public subscription and trading, all provisions in this law concerning public joint stock companies apply to private joint stock companies.”

A private joint stock company may be converted into a public joint stock company according to Article 208 if the following conditions are met: “The nominal value of the issued shares must be fully paid; at least two financial years must have passed since the company’s establishment; the company must have generated net distributable profits to shareholders, with an average of no less than 10% of the capital during the two financial years preceding the conversion request; a decision must be issued by the extraordinary general assembly with a majority of three-quarters of the company’s capital; and a ministerial decision must be issued announcing the company’s conversion to a public joint stock company, with the decision and the company’s articles of association and statutes published at the company’s expense.”

Limited Partnership by Shares

Chapter seven of this law defines the Limited Partnership by Shares and allocates articles (209) to (227) for it. Article (209) defines it as a company “consisting of two groups: one includes one or more general partners who are jointly and severally liable for all the company’s debts, and the other includes one or more limited partners who are only liable for the company’s debts up to the amount of their capital contributions.”

According to Article (212), the company’s capital is divided into “equal, negotiable shares that are indivisible.”

Article (213) stipulates that “the company’s capital shall not be less than one million Qatari riyals, fully paid upon establishment.”

Article (216) states that a “limited partner cannot intervene in the management of the company’s dealings with third parties, even under authorization. However, they may participate in internal management as specified in the company’s bylaws.”

For company management, Article (223) specifies that “one or more general partners manage the company, and their powers, responsibilities, and dismissal follow the rules governing managers in a general partnership.”

Limited Liability Company (LLC)

Chapter eight of this law defines the Limited Liability Company (LLC) and dedicates articles (228) to (263) for it. Article (228) defines it as a company “comprising one or more persons, with no more than fifty shareholders, and no partner shall be liable for the company’s debts beyond their capital contribution. The partners’ shares shall not be negotiable securities.”

According to Article (230), a Limited Liability Company “shall not resort to public subscription to form or increase its capital, or to obtain loans, nor can it issue negotiable shares or bonds.”

Article (249) entitles a non-managing partner in companies without a supervisory board to “offer advice to managers, and request access to the company’s affairs and inspect its records and documents at the company’s headquarters. Any provision to the contrary shall be null and void.”

Additionally, Article (262) requires the company to “deduct 10% of its annual net profits to form a legal reserve. The partners may decide to stop this deduction once the reserve reaches half of the capital. The legal reserve may be used to cover company losses or to increase its capital by a decision of the general assembly.”

Holding Company

Chapter nine defines the Holding Company and allocates articles (264) to (270) for it. Article (264) describes it as a “joint-stock company or a limited liability company that exerts financial and administrative control over one or more other companies, which become subsidiaries by holding at least 51% of their shares or quotas, whether they are joint-stock companies or limited liability companies.”

However, Article (265) prohibits the holding company from “owning shares in general partnerships or any form of limited partnerships, and it is also prohibited from owning shares or quotas in other holding companies.”

Furthermore, Article (270) states that unless in conflict with the provisions of chapter nine, “the rules governing joint-stock companies or limited liability companies shall apply, depending on the case.”

Based on the types of companies defined by law, everyone should understand that starting a private business is not entirely free from restrictions. There are specific regulations and laws that must be well understood, and consulting a lawyer is essential to determine the appropriate type of company.

The legal framework is crucial in defining the responsibilities and obligations of members, managers, and their liabilities towards creditors.

Additionally, the law provides specific definitions for institutions, including governmental, semi-governmental, non-profit, and public benefit institutions, and the concept of entrepreneurship.

We will discuss these in a separate article, God willing.