Humans are not just social beings but also dependent ones, with multiple needs they cannot fulfil independently. They contribute to society by offering services or goods in exchange for others. As societies advanced scientifically and economically, the list of essential products and services grew, ranging from food and healthcare to education, technology, and beyond.

In primitive societies, the concept of barter emerged. Still, it quickly became impractical for several reasons, such as the inability to divide goods into smaller units or the difficulty of transporting them. This led to the emergence of currency, with gold and silver playing a key role in valuing goods and services.

With the dawn of the digital age and its integration into media, education, and commerce, nations began exploring the creation of their digital currencies under government supervision. This movement paralleled or perhaps countered, the rise of cryptocurrencies, most notably Bitcoin, which first appeared in 2008.

On June 4, 2024, the Qatar Central Bank announced via its account on X the completion of infrastructure development for its digital currency project. It stated that the initiative would “evaluate applications of digital currency, leveraging the strength of existing technological systems to enhance the efficiency of the financial sector. The Central Bank will test and develop selected digital currency applications to settle high-value payments with local and international banks in a pilot environment designed using the latest advanced technologies.”

The Qatar Central Bank (QCB) website has outlined the reasons and objectives behind this initiative, highlighting that this project represents a modern approach to upgrading the country’s financial system by utilizing Distributed Ledger Technology (DLT), which leverages the advantages of blockchain while ensuring enhanced government oversight and full compliance with national laws and regulations.

The QCB further explained that the Central Bank digital currency (CBDC) project aims to issue a digital version of banknotes and coins, aligning with the evolving demands of the digital era, including digital payments and cryptocurrencies.

The website also notes that in the program’s first phase, the digital currency will only be used for high-value financial transactions by licensed financial institutions, such as interbank payments and the purchase of digital securities. It will not be available to the general public at this stage.

The QCB sees several advantages of the digital currency, including high security and transaction speed, which enhance transparency and credibility. Additionally, the currency is expected to support the country’s monetary policy and shield the economy from the influence of unregulated cryptocurrencies.

Moreover, the QCB believes that the stable value of the digital currency, pegged to the Qatari riyal, will ensure financial stability without impacting the balance sheets of banks or the central bank.

This initiative follows a warning issued by the Qatar Central Bank on February 8, 2018, cautioning financial institutions in the country against trading Bitcoin or other cryptocurrencies. According to financial sources and a circular reviewed by Reuters, the QCB instructed banks and exchange houses not to deal with cryptocurrencies in any form, including trading them, exchanging them for other currencies, opening accounts for cryptocurrency transactions, or sending/receiving funds for their purchase or sale.

On the other hand, Bitcoin supporters argue that any centralized approach to money contradicts the core philosophy of cryptocurrencies. Their main appeal lies in decentralization and absolute privacy. As such, they view any attempt to create a government-controlled digital currency as violating financial privacy. They argue that government digital currencies resemble cryptocurrencies in name only, much like trying to convince others that vinegar is no different from water simply because it is transparent. The true essence of a currency lies in its practical outcomes, not in theoretical claims or regulatory assurances.

Centuries ago, governments intervened in regulating gold transactions by minting their own gold coins, which retained their intrinsic value based on a clearly defined and agreed-upon standard.

One of the earliest known metal currencies was the Roman denarius in the 3rd century BC. Over time, successive emperors debased its value by altering its composition.

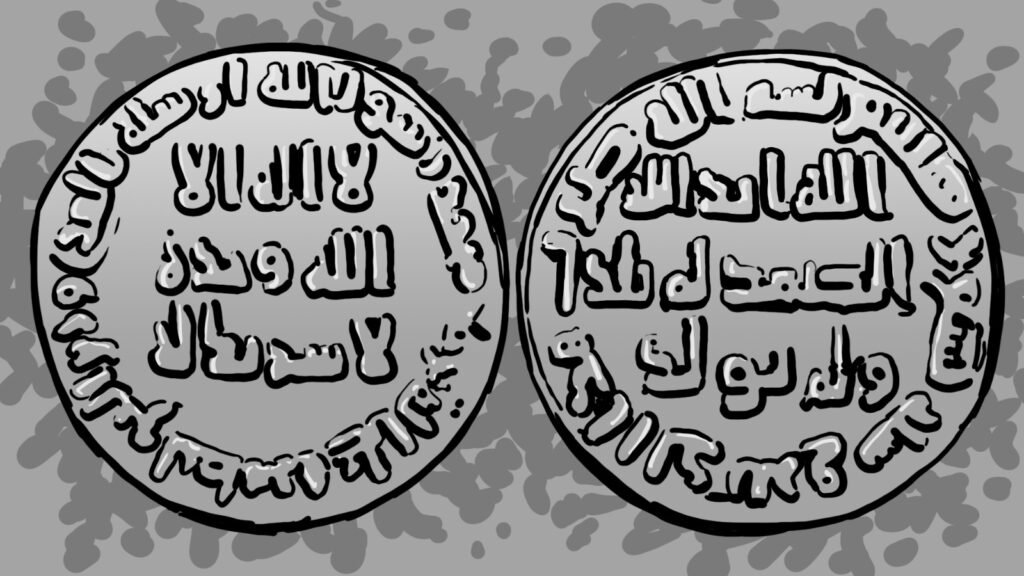

Between the 7th and 12th centuries, a strong monetary economy emerged in the Islamic world due to high levels of commercial trade. By the late 7th century AD, the Islamic gold dinar and silver dirham were introduced under the Umayyad Caliph Abd al-Malik ibn Marwan. These currencies remained in circulation until the fall of the Ottoman Caliphate in the early 20th century.

Promissory notes, known as bills of exchange, became widespread as commerce expanded in medieval Europe. Goods were exchanged for these notes, which promised payment at a future date. This system was beneficial given the dangers of travelling with large amounts of metal currency. Funds were deposited at a bank in one city, and in return, the depositor received a note that could be redeemed elsewhere.

In 16th-century Britain, goldsmiths emerged as key financial intermediaries. Merchants stored their gold with London goldsmiths for a fee, and in return, the goldsmiths issued receipts certifying the quantity and purity of the gold held in trust.

By 1616, Sweden became the first European country to issue paper currency through the Stockholm Bank, which later evolved into Sweden’s central bank.

Following World War II, the Bretton Woods Agreement 1944 was established to regulate monetary relations among independent states. Countries were required to peg their currencies to the U.S. dollar, backed by gold. The exchange rate was fixed at $35 per ounce of pure gold (equivalent to 0.88867 grams of gold per dollar). The International Monetary Fund (IMF) was created to oversee this system to monitor exchange rates and provide reserve currency loans to nations with balance of payment deficits.

However, the U.S. faced a growing negative balance of payments and mounting public debt, exacerbated by the Vietnam War. The Federal Reserve responded by increasing the money supply, leading to inflation and an overvaluation of the U.S. dollar.

By 1970, America’s gold reserves had declined from 55% to 22% of its obligations, causing global doubt about the U.S.’s ability to maintain the gold standard.

In 1971, the U.S. printed additional dollars and exported them to finance government spending on military and social programs.

During the first six months of 1971, $22 billion worth of U.S. assets were withdrawn from the country. In response, on August 15, 1971, President Richard Nixon issued Executive Order 11615 under the Economic Stabilization Act of 1970. He imposed wage and price controls for 90 days, introduced a 10% import surcharge, and, most significantly, terminated the convertibility of the U.S. dollar into gold, making it a purely fiat currency. This historic decision became known as the “Nixon Shock.”

With the gold backing removed, other nations also abandoned their gold standards, making the strength of a country’s currency dependent on its production of goods and services and its political and military influence on the global stage.

As a result, the savings of individuals in fiat currencies became vulnerable to international politics, economic instability, and central bank policies that determine the value of money.

Economist Dr. Saifedean Ammous, in his book The Bitcoin Standard: The Decentralized Alternative to Central Banking (2019), describes the modern monetary system as a deception, arguing that fiat money is nothing more than counterfeit wealth despite not being officially fraudulent. He means that the monetary system in countries is nothing but a global illusion designed to mislead savers into believing their money is safe. In reality, its purchasing power is continuously declining, which is evident in annual inflation and relentless price surges.

Ammous states, “The problem with government-backed money is that its stability depends entirely on the discretion of those in charge not to inflate its supply. Only political constraints maintain its current value—no physical, economic, or natural limitations exist on how much money governments can produce.”

Amid the global financial crisis, which U.S. banks triggered following the bursting of the subprime mortgage bubble and the massive printing of dollars, an anonymous entity—an individual or a group—known as Satoshi Nakamoto launched the website bitcoin.org on August 19, 2008. Later, on October 31 of the same year, Nakamoto published a whitepaper titled Bitcoin: A Peer-to-Peer Electronic Cash System (2008). (2008).

The Stance of Bitcoin Supporters

Dr. Saifedean Ammous believes that Bitcoin represents “a new technological solution to the problem of money, born from the digital age, utilizing many technological innovations developed over the past few decades, and benefiting from extensive experiments in producing digital money.”

From the perspective of its supporters, one of Bitcoin’s key advantages is that it resembles physical cash transactions without an intermediary in real time. However, simultaneously, it functions like digital payments between two parties not in the exact location, separated by geographical distance.

Bitcoin’s production and trading method is inherently decentralized, preventing external control. Its fixed supply of 21 million Bitcoins ensures that no additional units can be created, thereby preventing inflation caused by an oversupply and maintaining its value.

Due to its high-level encryption and lack of external oversight, Bitcoin transactions offer privacy and anonymity.

Since it is purely digital and does not rely on intermediaries, Bitcoin transactions are fast and inexpensive. It is in the best interest of network participants for Bitcoin to succeed, as they all benefit from its adoption.

Supporters also argue that money laundering is not exclusive to cryptocurrency transactions but is prevalent in the traditional financial system.

According to an article published on the U.S. State Department’s website, “Money laundering activities have also increased across all sources. The IMF and World Bank estimate that 3% to 5% of the global GDP is laundered annually, amounting to approximately $2.17 to $3.61 trillion.”

This raises a critical question: Has the traditional, centralized global financial system succeeded in preventing money laundering? Or are political, social, and developmental solutions the more effective approach?

Suppose people felt they had access to a dignified life with financial security for themselves and their families. Why would they risk losing it through illegal activities with severe legal consequences?

The Stance of Bitcoin Opponents

Bitcoin faces numerous accusations and warnings from major international institutions, including the International Monetary Fund (IMF), the World Bank, most academic institutions, and central banks worldwide—except for El Salvador, which has adopted Bitcoin in large quantities.

As for why academic institutions warn against cryptocurrencies, economist Lawrence White explains in a research paper published on ResearchGate, titled The Federal Reserve System’s Influence on Research in Monetary Economics (2005), that “The Federal Reserve System is not just a topic of research for American monetary economists; it is also one of the primary sponsors of their research.” He adds, “Slightly over 80% of these researchers had at least one co-author affiliated with the Federal Reserve System (either as a current or former employee of the U.S. Federal Reserve Bank, including appointments as visiting researchers).”

This stance is no different from that of the International Monetary Fund (IMF), which remains sceptical of cryptocurrencies. In an article published on the IMF’s website titled Comprehensive Policies Are Essential to Protect Economies and Investors in the Digital Asset Sector (2023), the authors—Tobias Adrian, Dong He, Aref Ismail, and Marina Moretti—stated that “To prevent the replacement of national currencies with digital assets, strong and trustworthy national institutions must be maintained. A transparent, consistent, and well-coordinated monetary policy framework is essential to address the challenges posed by digital assets.”

To safeguard national sovereignty, the authors argued that “Digital assets should not be granted the status of official currency or legal tender, as doing so could force nations to accept them for tax payments, fines, and debt settlements, potentially leading to financial risks, threats to monetary stability, and even rapid inflation.”

The Reason Behind the Bitcoin Phenomenon

Throughout history, no currency has ever gained value unless a group of people collectively agreed on its scarcity and significance. Imagine a plane making an emergency landing on a small, unknown island in the middle of the Atlantic Ocean. What would the value of the money in the passengers’ pockets be in their eyes? Nothing. Even if they carried millions of dollars.

Any material or immaterial asset derives its worth only when a group acknowledges its rarity and desires to possess it.

This is precisely what happened with Bitcoin—a purely symbolic, intangible entity that had no real value when it first emerged in 2008, yet gradually transformed into something of tangible worth, despite its existence being purely digital, confined to the minds of its believers.

Nathaniel Popper, in his book Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money (2015), writes:

“The most significant moment in Bitcoin’s history was the first day when the tokens on this network transitioned from being economically worthless to holding actual market value… In May 2010, Bitcoin was used for the first time in a real-world purchase when someone paid 10,000 bitcoins for two pizzas worth $25 at a rate of $0.0025 per bitcoin. Over time, more people heard about Bitcoin, became interested in buying it, and its price continued to rise.”

Those 10,000 bitcoins, which were worth $25 and exchanged for two pizzas in 2010, are today—at the time of writing this article—equivalent to nearly one billion dollars, or more precisely $966,942,300, based on the current value of one bitcoin is approximately $97,000.

If people felt economically stable and confident in their national currencies, they would not resort to a virtual currency that rises and falls like a roller coaster in an amusement park.